Tax season is here!

It’s that time of the year again, but there are many resources in the community that can help:

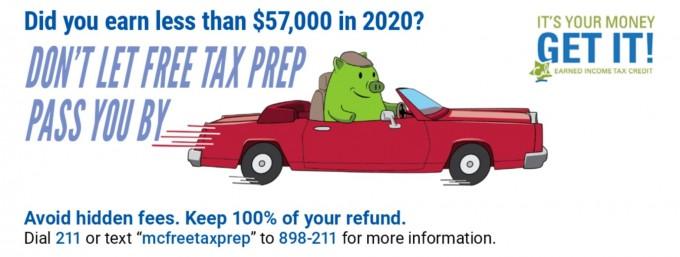

Free Tax Prep Help

Find more local free tax preparation help at https://irs.treasury.gov/freetaxprep/.

GetYourRefund.org

Prepare and file your taxes online with assistance from an IRS-certified VITA tax specialist at Getyourrefund.org

United Way Monterey County

Experts from the United Way’s Volunteer Income Tax Assistance (VITA) program will be helping individuals prepare their taxes during the pandemic with in-person, virtual, and drop-off appointments.

For more information, go to the United Way Tax Prep Site, call 211, or text mcfreetaxprep to 898-211.

VITA Sites:

- Center for Employment Training (CET): 24 E. Alvin Street, Salinas, 93906. For appointments, call (831) 424-0665 or email cetsal.vita@gmail.com. Service dates: 2/12 – 4/12

- United Way Monterey County – Salinas Office: 307 Main Street, Suite 100, Salinas, 93901. For appointments, call (831) 757-3206. Service dates: 2/12 – 4/15

- Center for Employment Training (CET) Soledad: 930 Los Coches Dr., Ste 101, Soledad, CA 93960. For appointments, call (831) 223-1074. Service dates: 02/12–04/10

- United Way Monterey County-Monterey Office: 60 Garden Ct., Ste. 350, Monterey, CA 93940. For appointments, call (831) 757-3206. Service dates: 02/12–04/10

Individuals must have earned less than $57,000 in 2020 and are required to bring their:

- Social security card or ITIN card for taxpayer, spouse, and dependents,

- W-2s or 1099s from all employers and other tax forms,

- Photo ID,

- Bank account and routing numbers for direct deposit,

- Health coverage information, and

- Last year’s federal and state tax forms if available.

Alliance on Aging

The Alliance on Aging Tax Counseling for the Elderly (TCE) Program provides IRS-Certified staff and volunteers to help adults 60 years and older, as well as the blind and disabled, complete their taxes. The program operates between February 1 and April 15th. Services are provided free to those with low to moderate income, and are provided in English and Spanish.

They are now open for tax appointments. Click here to make an appointment.

For questions, call (831) 655-1334 or visit their Tax Counseling for the Elderly program website to get all of your questions answered.

Tax Forms

- Download Federal tax forms

- Download California state tax forms

- Order Federal Tax forms by calling 1-800-829-3676.

More information on ordering Federal Tax forms by phone or U.S. Mail. - Order California State booklets (with forms) by calling 1-800-338-0505.

More information on ordering California State booklets (with forms) by phone.

Where to File Returns

Get Help

Federal Assistance: Internal Revenue Service (IRS)

Online Resources:

- Web site: www.irs.gov

- Forms: www.irs.gov/forms-instructions

- IRS Free File Service

Help by Phone/Fax:

- For recorded tax & refund information: 1-800-829-4477

- TDD 1-800-829-4059

- For Forms and Publications: 1-800-829-3676

- For Tax information & notice inquiries: 1-800-829-1040

- For the Problem Resolution Program: 1-800-829-1040

- For CD-ROM orders: 1-877-233-6767

- For Taxpayer Education: 1-800-829-1040

- IRS TaxFax: (703) 368-9694

The best time to call the IRS is at 8:00 a.m. in the morning, or in the afternoon between the hours of 3:00 – 4:00 p.m.

State Assistance: California State Franchise Tax Board

Online Resources:

- Website: https://www.ftb.ca.gov/

- Forms: https://www.ftb.ca.gov/forms/index.html

- CalFile: free online filing service

Help by Phone:

- Live telephone assistance: 800-852-5711

- Automated telephone assistance: 800-338-050